Analyzing Netflix’s Growth Strategy Using the BCG Matrix

In the highly competitive world of online streaming, Netflix has emerged as a dominant player, revolutionizing the way we consume entertainment. This article will delve into Netflix’s growth strategy by analyzing its position in the market using the BCG Matrix. The BCG Matrix, developed by the Boston Consulting Group, is a strategic tool used to evaluate a company’s portfolio of products or services based on their growth potential and market share.

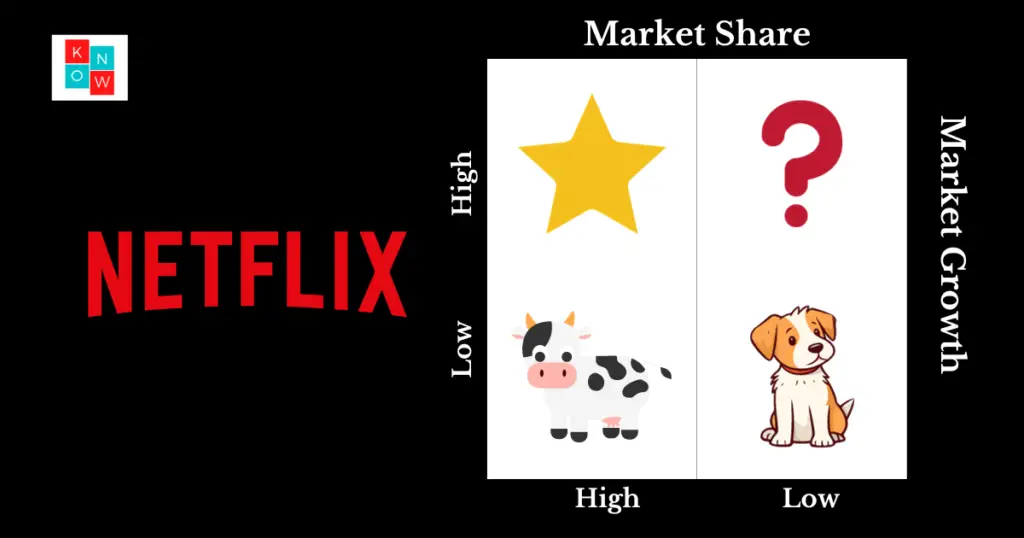

BCG Matrix of Netflix

Cash Cow - Streaming Service

Netflix’s primary cash cow is undoubtedly its streaming service. With a vast library of movies, TV shows, and original content, it has captured a significant market share. The streaming service generates substantial revenue and enjoys a loyal customer base. Although the market is saturated, Netflix’s competitive advantage lies in its superior user experience and personalized recommendations, allowing it to maintain its market dominance.

Star - Original Content

Netflix’s investment in original content has paid off handsomely, positioning it as a star in the BCG Matrix. By producing high-quality series, documentaries, and movies, Netflix has attracted a massive audience worldwide. Hits like “Stranger Things” and “The Crown” have become cultural phenomena, driving subscriber growth and increasing market share. The success of its original content has allowed Netflix to differentiate itself from competitors and continue to expand its customer base.

Question Mark - International Expansion

Netflix’s international expansion efforts can be classified as a question mark on the BCG Matrix. While the company has made significant strides in penetrating global markets, it faces challenges in terms of local competition, pricing, and content localization. However, the potential for growth in untapped markets such as India, Brazil, and Southeast Asia is substantial. Netflix’s strategy of investing in local-language content and partnerships with regional production companies demonstrates its commitment to capturing these markets.

Dog - DVD Rental Service

Netflix’s DVD rental service, once its flagship offering, can now be considered a dog in the BCG Matrix. With the rise of streaming, the demand for physical DVDs has declined significantly. Netflix has shifted its focus to streaming, leading to a decline in the DVD rental business. While the service still generates some revenue, its market share and growth potential are limited. However, Netflix continues to cater to a niche market of customers who prefer physical media.

Conclusion

Analyzing Netflix’s position in the BCG Matrix provides valuable insights into its growth strategy. The streaming service remains its cash cow, generating significant revenue and maintaining market dominance. The success of its original content has positioned Netflix as a star, driving subscriber growth and expanding its market share. International expansion represents a question mark, with immense growth potential if Netflix can overcome local challenges. Lastly, the DVD rental service has become a dog, as the market shifts towards digital streaming. By understanding its portfolio’s position, Netflix can make informed strategic decisions to sustain its growth trajectory in the highly competitive streaming industry.

What’s up to all, how is everything, I think every one is getting more from this web site, and your views are pleasant in support of new visitors.

Pingback: personal essay help