Analyzing Maruti Suzuki’s Market Position Using the BCG Matrix

The Boston Consulting Group (BCG) matrix is a strategic management tool that helps businesses evaluate their portfolio of products or services. In this blog post, we will explore how Maruti Suzuki, one of India’s leading automobile manufacturers, can be analyzed using the BCG matrix. By understanding the company’s market position and growth potential, we can gain insights into its strategic decisions and future prospects.

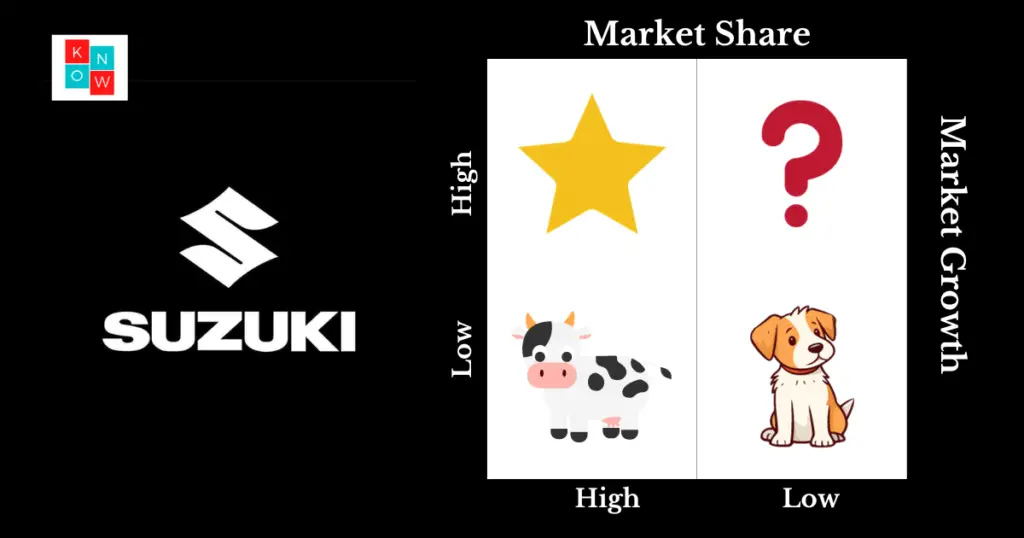

The BCG Matrix Overview

The BCG matrix categorizes a company’s products or services into four quadrants based on their market growth rate and relative market share. The quadrants are as follows:

a. Stars: Products with high market growth rate and high market share.

b. Cash Cows: Products with low market growth rate but high market share.

c. Question Marks: Products with high market growth rate but low market share.

d. Dogs: Products with low market growth rate and low market share.

BCG Matrix of Maruti Suzuki

Maruti Suzuki's Stars

Maruti Suzuki has several products that can be categorized as “Stars” in the BCG matrix. These include successful models like the Swift and Baleno, which have high market share and are experiencing robust growth in the competitive Indian automobile market. Maruti Suzuki’s focus on innovation, quality, and customer-centric approach has contributed to the success of these models. The company needs to continue investing in them to maintain their growth trajectory.

Cash Cows in Maruti Suzuki's Portfolio

Maruti Suzuki has a strong presence in the compact car segment in India. Models like the Alto and Wagon R have dominated this segment for years, commanding a significant market share. These products are considered “Cash Cows” in the BCG matrix as they generate substantial revenue and have a loyal customer base. While their growth rate may not be as high as that of the “Stars,” they continue to contribute significantly to Maruti Suzuki’s profitability.

Question Marks and Potential Growth Areas

Maruti Suzuki has a few products that fall under the “Question Marks” category in the BCG matrix. These include electric vehicles (EVs) and premium models like the Ciaz and S-Cross. While these products have potential for growth, they currently have a relatively low market share. Maruti Suzuki needs to focus on strategic marketing and product development to increase their market share and capitalize on the growing demand for EVs and premium vehicles in India.

Dogs in Maruti Suzuki's Portfolio

Maruti Suzuki does not have significant products that can be classified as “Dogs” in the BCG matrix. However, it is crucial for the company to monitor the performance of its older models and discontinue any that are not generating sufficient revenue or have become obsolete in the market.

Conclusion

The BCG matrix provides valuable insights into Maruti Suzuki’s product portfolio and market position. By identifying “Stars,” “Cash Cows,” “Question Marks,” and addressing potential “Dogs,” the company can make informed strategic decisions. Maruti Suzuki’s focus on innovation, customer satisfaction, and market trends will be instrumental in maintaining its position as a market leader in the Indian automobile industry. Utilizing the BCG matrix can help Maruti Suzuki allocate resources effectively and prioritize future investments based on market growth and market share.