Analyzing Jio’s Product Portfolio Using the BCG Matrix

In today’s dynamic business environment, it is crucial for companies to assess their product portfolio and make informed decisions about resource allocation and growth strategies. One such tool is the BCG Matrix, which helps analyze a company’s products based on their market share and growth rate. In this blog post, we will delve into the BCG Matrix analysis of Jio, one of India’s leading telecommunications companies, to understand its market position and potential for future growth.

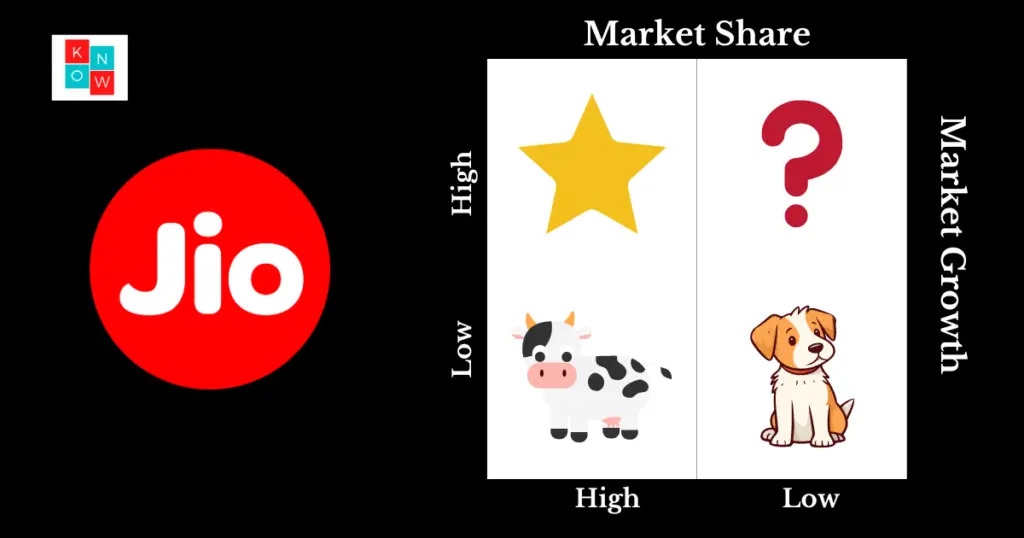

What is the BCG Matrix

The BCG Matrix, developed by the Boston Consulting Group, is a strategic planning tool that categorizes a company’s products into four quadrants based on their market share and growth rate. The four quadrants are: Stars, Cash Cows, Question Marks, and Dogs.

Stars: Products with high market share and high growth rate. These are the company’s most promising offerings, requiring substantial investment to maintain their growth.

Cash Cows: Products with high market share but low growth rate. These products generate significant cash flow and should be milked for profits to fund other ventures.

Question Marks: Products with low market share but high growth rate. These products have the potential to become stars but require careful investment decisions for future success.

Dogs: Products with low market share and low growth rate. These products may not be profitable and should be considered for divestment or discontinuation.

BCG Matrix of Jio

Jio's Stars

Jio’s stars in the BCG Matrix are its various digital services, such as Jio Fiber, JioSaavn, and JioCinema. These services have experienced rapid growth and have gained a significant market share in their respective industries. Jio Fiber, for instance, provides high-speed internet and has become a popular choice for home and business users. JioSaavn, a music streaming platform, has gained traction among music lovers, while JioCinema offers a wide range of movies and TV shows.

To maintain their star status, Jio needs to continue investing in technological advancements and customer-centric features. This will help them stay ahead of the competition and further expand their market share. Additionally, Jio should focus on building customer loyalty and providing a seamless user experience to retain its existing customer base.

Jio's Cash Cows

Jio’s cash cows can be identified in its core telecommunications services, including Jio mobile network and JioFiber broadband services. These services have captured a significant market share and generate a steady stream of revenue for the company. Jio’s mobile network has disrupted the Indian telecom industry by offering affordable and high-speed connectivity, leading to a substantial customer base.

To maximize the potential of its cash cows, Jio should focus on maintaining its network quality, providing excellent customer service, and exploring opportunities for upselling and cross-selling. By leveraging its existing customer base, Jio can introduce new services and offerings to generate additional revenue streams.

Jio's Question Marks

Jio’s question marks can be seen in its foray into various sectors such as e-commerce, healthcare, and education. These ventures have the potential for rapid growth but currently have a relatively low market share. JioMart, the company’s online grocery platform, is a prime example of a question mark. Although it is still in its early stages, JioMart has the potential to disrupt the Indian e-commerce market dominated by established players.

To turn these question marks into stars, Jio needs to carefully invest resources, conduct market research, and develop innovative strategies. By identifying customer needs and preferences, Jio can tailor its offerings and gain a competitive edge in these emerging sectors.

Jio's Dogs

Jio does not have any significant products falling under the dog category. However, it is essential for the company to regularly assess its portfolio to ensure that none of its offerings become unprofitable or obsolete. By monitoring market trends and customer preferences, Jio can identify any products that may be declining in market share and take appropriate actions, such as revamping or discontinuing them.

Conclusion

The BCG Matrix analysis helps us understand Jio’s product portfolio and its market position. By identifying stars, cash cows, question marks, and dogs, Jio can make informed decisions about resource allocation, investment priorities, and growth strategies to stay competitive in the dynamic telecommunications industry.