Analyzing Domino’s Pizza Using the BCG Matrix

The BCG Matrix, also known as the Boston Consulting Group Matrix, is a strategic management tool used to analyze a company’s product portfolio. In this blog post, we will explore how the BCG Matrix can be applied to Domino’s Pizza, one of the leading global pizza delivery chains. By understanding the position of Domino’s products in the market, we can gain insights into their growth potential and make informed strategic decisions.

BCG Matrix of Domino’s

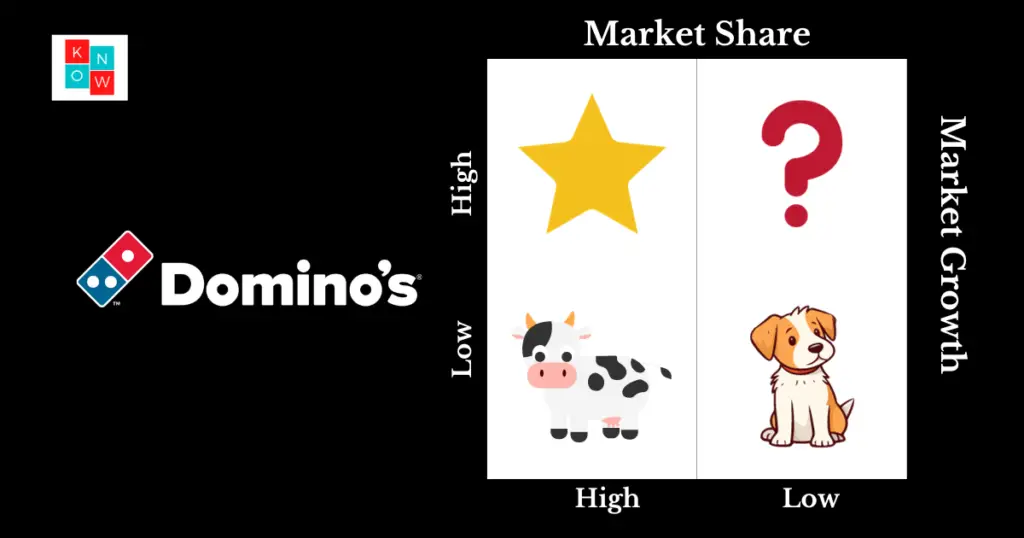

The BCG Matrix categorizes a company’s products into four quadrants: Stars, Question Marks, Cash Cows, and Dogs. Each quadrant represents a different level of market growth and market share.

Stars

Stars are products with high market share in rapidly growing markets. These products have the potential to generate significant revenue and profits. In the case of Domino’s Pizza, their range of classic pizzas, such as Margherita, Pepperoni, and Hawaiian, can be considered stars. These products have a strong market presence and continue to experience high demand in the growing pizza delivery industry.

Question Marks

Question Marks are products with low market share in fast-growing markets. These products require careful consideration and investment to determine their future potential. In Domino’s case, their newer offerings, such as gluten-free or plant-based pizzas, can be seen as question marks. These products are still in the early stages of market penetration and their success is uncertain.

Cash Cows

Cash Cows are products with high market share in slow-growing markets. These products generate steady cash flow but have limited growth potential. In the case of Domino’s, their side dishes like breadsticks, chicken wings, and desserts, can be considered cash cows. These products are popular and have a dedicated customer base, but their growth prospects are limited due to the maturity of the market.

Dogs

Dogs are products with low market share in slow-growing markets. These products may not generate significant profits and are often candidates for divestment. In the case of Domino’s, any product that does not gain traction or fails to meet customer expectations would fall into this category. However, it is important to note that Domino’s has been successful in avoiding products that are considered dogs.

Strategic Implications

The BCG Matrix provides valuable insights for making strategic decisions regarding a company’s product portfolio. For Domino’s Pizza, the matrix suggests several implications:

Invest in Stars

Domino’s should continue to invest in their star products, such as their classic pizzas, to maintain and strengthen their market position. This can include marketing campaigns, product innovations, and expanding their delivery network to capture a larger market share.

Evaluate Question Marks

Domino’s should carefully evaluate their question mark products, such as gluten-free or plant-based pizzas, to determine their potential for growth. If these products show promise, the company should allocate resources to further develop and promote them. If not, it may be necessary to discontinue them to focus on more promising opportunities.

Leverage Cash Cows

Domino’s should leverage their cash cow products, like side dishes, to generate steady cash flow. They can consider bundling these items with their pizza offerings or introducing new variants to maintain customer interest.

Monitor Dogs

Domino’s should continuously monitor their products to ensure none fall into the dog category. Any underperforming or outdated products should be reassessed and either improved or phased out.

Conclusion

Using the BCG Matrix, we can analyze Domino’s Pizza’s product portfolio and gain insights into their growth potential. By identifying their star, question mark, cash cow, and dog products, Domino’s can make informed strategic decisions. Investing in stars, evaluating question marks, leveraging cash cows, and monitoring dogs will help Domino’s maintain a strong market position and maximize profitability.

Understanding the BCG Matrix allows companies like Domino’s Pizza to prioritize resources, align their product strategies with market trends, and ensure a sustainable competitive advantage. By constantly evaluating and adapting their product portfolio, Domino’s can continue to provide customers with quality pizza offerings while staying ahead of the competition.