Analyzing Cadbury’s Product Portfolio using the BCG Matrix

In the competitive world of the chocolate industry, Cadbury has managed to establish itself as a leading brand. One of the key factors contributing to Cadbury’s success is its diverse product portfolio. To better understand and analyze the performance of Cadbury’s products, we can use the BCG Matrix. The BCG Matrix is a strategic tool that helps companies classify their products into four categories based on their market growth rate and market share. In this blog post, we will explore how the BCG Matrix can be applied to Cadbury’s product range, providing insights into its current market position and future growth prospects.

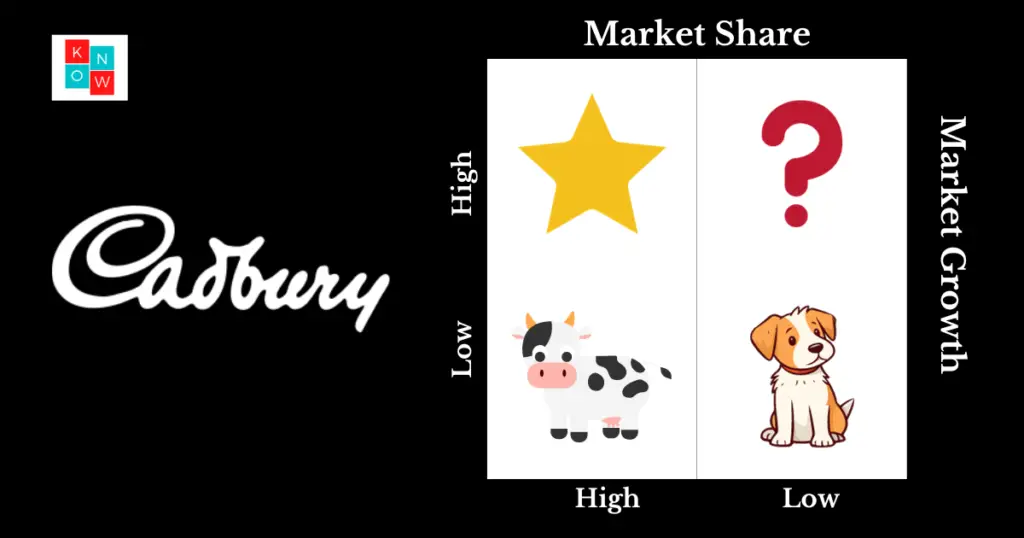

BCG Matrix of Cadbury

The BCG Matrix is a strategic management tool used to analyze and evaluate the performance of a company’s product portfolio. In this case, we will be examining Cadbury, a well-known confectionery brand. The BCG Matrix categorizes products into four quadrants based on their market growth rate and relative market share.

Cash Cows

Cash cows are products with a high market share in a low-growth market. For Cadbury, cash cows could be their well-established and popular products like Dairy Milk and Bournville. These products have a loyal customer base and generate significant revenue for the company. Cadbury can continue to invest in these cash cows to maintain their market dominance and maximize profitability.

Stars

Stars represent products with a high market share in a high-growth market. In Cadbury’s case, new and innovative products that have gained substantial popularity could be considered stars. For example, Cadbury’s Oreo chocolate bars or their collaboration with Marvellous Creations are products that have the potential to dominate the market and drive significant revenue growth. Cadbury should allocate resources to these stars to further capitalize on their success and ensure sustained growth.

Question Marks

Question marks, also known as problem children, are products with low market share in high-growth markets. These products have the potential for growth but require careful investment and strategic decisions. For Cadbury, this could include new product lines or variations that have yet to gain significant market share. By closely monitoring these question marks and investing in marketing and research, Cadbury can transform them into stars or phase them out if they fail to gain traction.

Dogs

Dogs are products with low market share in low-growth markets. These products generate limited revenue and have little growth potential. In Cadbury’s portfolio, some older or less popular products may fall into this category. While these products may have nostalgic value or niche market appeal, Cadbury should evaluate their profitability and consider discontinuing or repositioning them to focus on more lucrative opportunities.

Conclusion

The BCG Matrix provides a valuable framework for Cadbury to evaluate and strategize its product portfolio. By understanding the position of each product in terms of market growth and market share, Cadbury can make informed decisions on resource allocation, marketing efforts, and overall portfolio management. Continuously analyzing and adapting their product mix using the BCG Matrix will help Cadbury maintain its market leadership and sustain growth in the ever-evolving chocolate industry.